Apple has just released its financial results for the first quarter of fiscal 2014, which runs from the beginning of October to the end of December.

The company earned $13.1 billion in profit on a record $57.6 billion in revenue. Both the revenue numbers and the company's 37.9 percent gross margin were in line with the guidance Apple released at the end of last quarter...

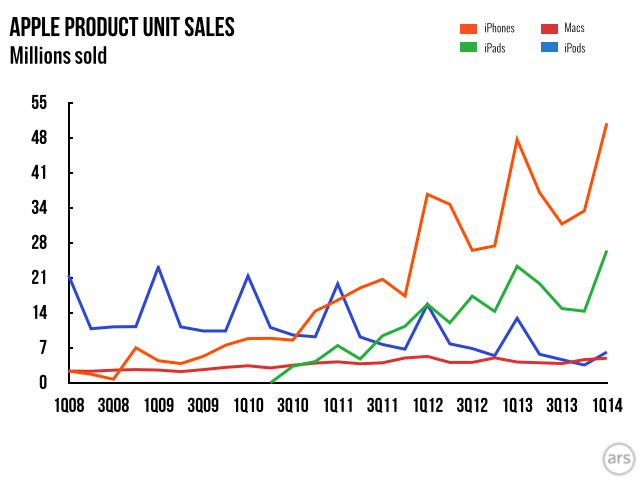

As usual, the iPhone, iPad, and Mac were Apple's three biggest revenue drivers. This was the first full quarter of availability for the iPhone 5S and 5C, and new iPads and Retina MacBook Pros were released early in the quarter. Apple sold 51 million iPhones, up from 47.79 million in the year-ago quarter; 26 million iPads, up from 22.86 million a year ago; and 4.84 million Macs, up from 4.06 million last year. These three categories alone make up 87.4 percent of Apple's total revenue. The iPhone and iPad numbers represent new quarterly records for the company, while this is the first significant year-over-year increase in Mac sales the company has experienced in some time.

The iPod continued its long, slow slide this quarter. It sold 6.05 million units, down from 12.68 million a year ago. It's worth noting that Apple didn't refresh the iPod lineup this year, opting to keep its 2012 products around for at least another year. However, the iPod line's sales continue to be eaten up by smartphones and tablets whether new models are released or not. The entire lineup accounted for just 1.7 percent of the revenue pie this quarter, and Apple expects the iPod to continue its decline.

Sales for iTunes, software, and services were up slightly, earning the company $4.4 billion compared to $3.69 billion a year ago. The increase comes despite a decrease in digital music sales for the year, as well as Apple's decision to give most of its major software (including OS X and the iLife and iWork apps) away for free. Apple expects to defer about $11 billion in total revenue because of this decision, with around $8 billion of that coming in 2014.

While Apple's gross margin is down slightly from the 38.6 percent the company managed a year ago, it's up compared to the quarters that precede it—Apple maintained a gross margin of 37 percent in Q4 of 2013 and 36.9 percent in Q3. Apple attributed the margins to a strong product mix and favorable pricing for the components that go into its products. These margins are still down from the margins in the mid-to-low-40s that Apple enjoyed through most of 2011 and 2012, but the numbers don't appear to be eroding further. Though the company brought in more revenue than it did last year, the slight decline in gross margins means that it made about the same amount of profit.

Apple has occasionally been known to drop minor product announcements on its earnings call, but this has been much rarer under Tim Cook. Cook's earnings calls follow a predictable pattern in which the company announces the straight numbers, offers a little reasoning as to why the numbers are what they are, and then gently deflects analyst questions about future plans. Regarding future plans, Cook would only say that Apple's customers "are going to love what we're going to do."

Apple's guidance for the next quarter predicts that the company will rake in between $42 and $44 billion in revenue with a gross margin between 37 and 38 percent. This is roughly flat compared to the $43.6 billion in revenue and the 37.5 percent margin the company reported in the year-ago quarter.

No comments:

Post a Comment