The Dow Jones Industrial Average briefly plummeted more than 1,000 points on Monday, marking the index’s largest one-day point decline ever on an intraday basis, as intensifying growth fears sparked steep stock-market losses world-wide...

The blue-chip benchmark dropped as much as 1089 points at the open before paring some of its losses. It was recently down 516 points, or 3.1%, to 15941.

The S&P 500 dropped 55 points, or 2.9%, to 1914, entering correction territory. The index hit an intraday low of 1866.86.

The Nasdaq Composite tumbled 150 points, or 3.2%, to 4555 after earlier dropping as low as 4292.14.

Investors stampeded into relatively safe assets such as U.S. government bonds, the Swiss franc and the yen. The yield on the 10-year Treasury notedropped below 2% during Asian trading and recently was 1.976%, the lowest level since April.

Before the market opened, Dow futures, S&P 500 futures and Nasdaq 100 futures triggered circuit breakers after falling at least 5%.

The New York Stock Exchange operator NYSE Group Inc. invoked the rarely used “Rule 48,” which relaxes some trading rules in a bid to ensure a smooth opening to trading. The rule is instituted when trading before the start of the regular session is especially volatile.

At the market open on Monday, a slew of single stocks and exchange-traded products triggered single-stock circuit breakers, which are initiated when there is a price drop of 10% or more in a five-minute period.

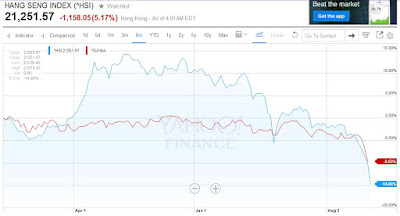

Fresh signs of a slowdown in China, the world’s second largest economy, have jolted stocks, bonds, currencies and commodities in recent days. Investors were further rattled Monday by the lack of fresh steps to stem the selloff over the weekend from Chinese authorities.

The Wall Street Journal reported that the Chinese central bank was preparing to flood the banking system with liquidity to increase lending, the latest in a series of measures designed to give the flagging economy a boost.

“A lot of markets abroad have seen a low amount of liquidity so investors are turning to the U.S. market to hedge,” said Jeffrey Yu, head of single-stock derivatives trading at UBS AG. Before the market opened, traders said futures volumes were extraordinarily heavy.

While the selloff began as an emerging markets story, with China’s stock market offering very little liquidity to investors due in part to technical stock-trading halts, investors have had to turn to the most liquid market to sell, which is the U.S., Mr. Yu said.

The Dow Jones Industrial Average, which has heavy international exposure, entered correction territory on Friday, defined as a decline of 10% from a recent peak.

Investors are increasingly skeptical that the U.S. Federal Reserve will raise interest rates at its meeting next month, amid growing turmoil in global markets and plunging inflation expectations.

A gauge of 10-year inflation expectations in the U.S. government bond market fell to the lowest level since 2009. Fed officials have said they intend to pursue policies that will enable inflation to rise to its 2% target in the medium term.

Fed-funds futures, used by investors and traders to place bets on central bank policy, showed Monday that investors and traders see a 28% likelihood of a rate increase at the September 2015 meeting, according to data from the CME Group. The probability was nearly halved from a week ago.

In a sign of growing anxiety, haven bonds have outperformed stocks and emerging market assets over the past few months. U.S. Treasurys maturing in at least a decade have handed investors a total return of 6.8% this quarter through Friday, according to data from Barclays PLC. The S&P 500 lost 4.2% in the same period and the MSCI Emerging Markets index lost 11.5%. Total return includes price gains and interest or dividend payments.

Source:http://www.wsj.com/articles/u-s-stocks-set-to-tumble-again-as-global-market-selloff-continues-1440418890

No comments:

Post a Comment