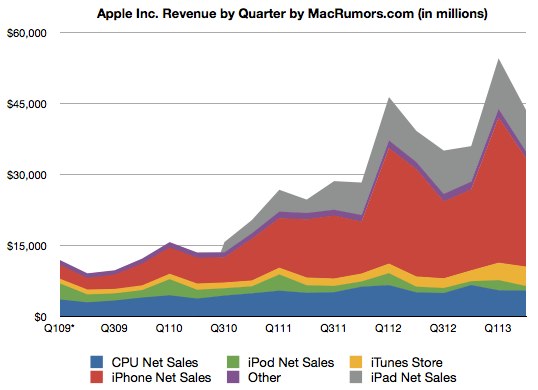

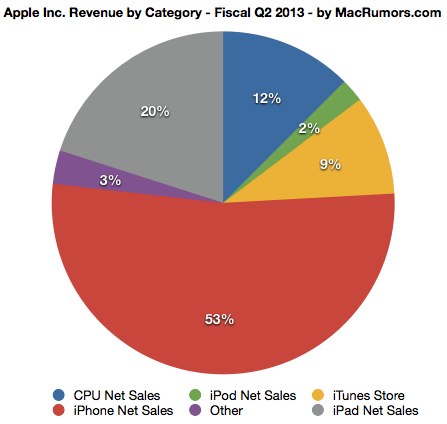

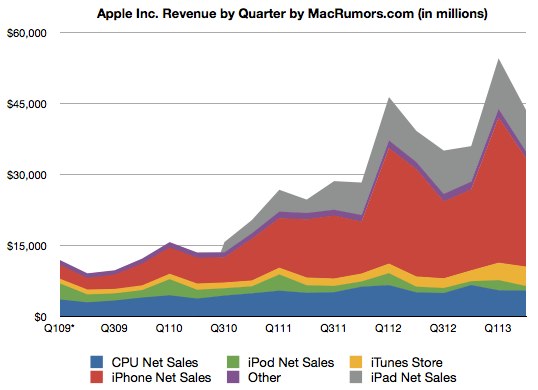

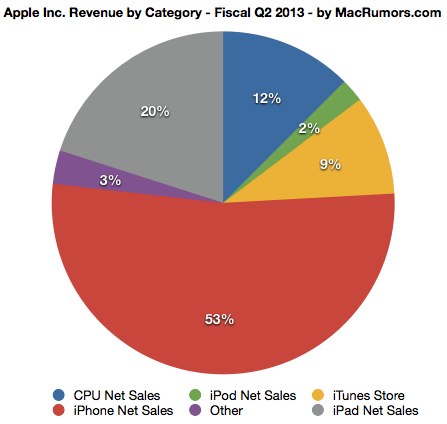

Apple today announced financial results for the first calendar quarter of 2013 and second fiscal quarter of 2013. For the quarter, Apple posted revenue of $43.6 billion and net quarterly profit of $9.5 billion, or $10.09 per diluted share, compared to revenue of $39.2 billion and net quarterly profit of $11.6 billion, or $12.30 per diluted share in the year-ago quarter.

Gross margin for the quarter was 37.5 percent compared to 47.4 percent in the year-ago quarter, with international sales accounting for 66 percent of revenue. Apple also declared a increased dividend payment of $3.05 per share, payable on May 16 to shareholders as of the close of trading on May 13. The company currently holds $145 billion in cash and marketable securities.

In addition to the increase in the dividend payment, Apple said it will dramatically increaseits share repurchase authorization to $60 billion from $10 billion. The company says it expects to spend $100 billion in cash under its capital return program by the end of 2015. Apple is now paying $11 billion per year in dividends to shareholders.

Quarterly iPhone unit sales reached 37.4 million, compared to 35.1 million in the year-ago quarter, and the company sold 19.5 million iPads, up from 11.8 million in the year-ago quarter. Apple sold just under 4 million Macs compared to 4 million in the year-ago period.

Apple will provide live streaming of its Q1 2013 financial results conference call at 2:00 PM Pacific, and MacRumors will update this story with coverage of the conference call highlights.

Apple's stock price is trading up more than five percent after hours as the market reacts to the earnings news.

Conference Call Highlights

- "A lot of news to share with you today" regarding March quarter and capital return program.

- Halfway through fiscal 2013 year, introduced and ramped production of unprecedented number of new products.

- Revenue was more than $98 billion, net income more than $22 billion.

- 85 million iPhones, 42 million iPads. Unimaginable to us a few years ago.

- Beat our guidance but didn't meet everyone's expectations.

- Achieved incredible scale and financial success. Margins have decreased and growth has slowed.

- Revenues grew $13 billion in first half of the year. Average weekly growth slowed to 19%. Gross margins closer to levels from a few years ago.

- Year over year comparisons difficult because of incredible 2012.

- iPad Mini pushed margins down.

- Guiding to same revenue but decline in margins.

- Decline in stock price has been frustrating, but Apple remains strong and we will continue to do what we do best. Can't control exchange rates and world economies and certain cost pressures.

- Most important objective is to create innovative products.

- Continue to focus on the long term, remain very optimistic in our future.

- Participating in large and growing markets, see lots of promise in front of us.

- Great ecosystem.

- Potential of exciting new product categories.

- Smartphone market will double between 2012 and 2016, to 1.4 billion units annually. Tablets growing even faster.

- Amazing new hardware, software and services coming this fall and throughout 2014.

- Strongest ecosystem in the industry.

- Highest loyalty and customer satisfaction rates in the industry.

- Focus on the world's best products that change people's lives.

- Same company that brought the iPhone and iPad, and have a lot more surprises in the works.

- Returned $10 billion under share repurchase and dividend payments.

- Continue to generate cash in excess of our needs.

- Firmly committed to attractive returns to shareholders through business growth and return of capital.

- Return $100 billion by the end of calendar 2015.

- Concluded that investing in Apple was the best option.

- Increasing dividend by 15%, will access the debt markets.

- Appreciate input from so many shareholders. Will evaluate yearly and will continue to invest in the business.

- Disciplined but will not underinvest.

- New March quarter records for iPhone and iPad sales, new record for iTunes sales.

- Strong growth in iPhone and iPad sales.

- 37.4 million iPhones sold, up from 35.1 million y/y. 7% growth. 11.6 million in channel inventory, up 1 million sequentially. In target range of 4-6 weeks of inventory. #1 spot in U.S. smartphone market for 3-months ending in February. iPhone number 1 in Japan for all of calendar 2012 and Q4 2012. First time a non-Japanese company has achieved the number one spot for an entire year.

Gross margin for the quarter was 37.5 percent compared to 47.4 percent in the year-ago quarter, with international sales accounting for 66 percent of revenue. Apple also declared a increased dividend payment of $3.05 per share, payable on May 16 to shareholders as of the close of trading on May 13. The company currently holds $145 billion in cash and marketable securities.

In addition to the increase in the dividend payment, Apple said it will dramatically increaseits share repurchase authorization to $60 billion from $10 billion. The company says it expects to spend $100 billion in cash under its capital return program by the end of 2015. Apple is now paying $11 billion per year in dividends to shareholders.

Quarterly iPhone unit sales reached 37.4 million, compared to 35.1 million in the year-ago quarter, and the company sold 19.5 million iPads, up from 11.8 million in the year-ago quarter. Apple sold just under 4 million Macs compared to 4 million in the year-ago period.

“We are pleased to report record March quarter revenue thanks to continued strong performance of iPhone and iPad,” said Tim Cook, Apple’s CEO. “Our teams are hard at work on some amazing new hardware, software and services, and we are very excited about the products in our pipeline.”Apple's guidance for the third quarter of fiscal 2013 includes expected revenue of $33.5-35.5 billion and gross margin between 36 and 37 percent.

Apple will provide live streaming of its Q1 2013 financial results conference call at 2:00 PM Pacific, and MacRumors will update this story with coverage of the conference call highlights.

Apple's stock price is trading up more than five percent after hours as the market reacts to the earnings news.

Conference Call Highlights

- "A lot of news to share with you today" regarding March quarter and capital return program.

- Halfway through fiscal 2013 year, introduced and ramped production of unprecedented number of new products.

- Revenue was more than $98 billion, net income more than $22 billion.

- 85 million iPhones, 42 million iPads. Unimaginable to us a few years ago.

- Beat our guidance but didn't meet everyone's expectations.

- Achieved incredible scale and financial success. Margins have decreased and growth has slowed.

- Revenues grew $13 billion in first half of the year. Average weekly growth slowed to 19%. Gross margins closer to levels from a few years ago.

- Year over year comparisons difficult because of incredible 2012.

- iPad Mini pushed margins down.

- Guiding to same revenue but decline in margins.

- Decline in stock price has been frustrating, but Apple remains strong and we will continue to do what we do best. Can't control exchange rates and world economies and certain cost pressures.

- Most important objective is to create innovative products.

- Continue to focus on the long term, remain very optimistic in our future.

- Participating in large and growing markets, see lots of promise in front of us.

- Great ecosystem.

- Potential of exciting new product categories.

- Smartphone market will double between 2012 and 2016, to 1.4 billion units annually. Tablets growing even faster.

- Amazing new hardware, software and services coming this fall and throughout 2014.

- Strongest ecosystem in the industry.

- Highest loyalty and customer satisfaction rates in the industry.

- Focus on the world's best products that change people's lives.

- Same company that brought the iPhone and iPad, and have a lot more surprises in the works.

- Returned $10 billion under share repurchase and dividend payments.

- Continue to generate cash in excess of our needs.

- Firmly committed to attractive returns to shareholders through business growth and return of capital.

- Return $100 billion by the end of calendar 2015.

- Concluded that investing in Apple was the best option.

- Increasing dividend by 15%, will access the debt markets.

- Appreciate input from so many shareholders. Will evaluate yearly and will continue to invest in the business.

- Disciplined but will not underinvest.

- New March quarter records for iPhone and iPad sales, new record for iTunes sales.

- Strong growth in iPhone and iPad sales.

- 37.4 million iPhones sold, up from 35.1 million y/y. 7% growth. 11.6 million in channel inventory, up 1 million sequentially. In target range of 4-6 weeks of inventory. #1 spot in U.S. smartphone market for 3-months ending in February. iPhone number 1 in Japan for all of calendar 2012 and Q4 2012. First time a non-Japanese company has achieved the number one spot for an entire year.